View Procedure

| Procedure Name | Customs appeal procedure | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Description |

Required Documentation

Process Steps

| ||||||||||||||||||||||||||

| Category | Procedure |

| Title | Description | Created Date | Updated Date | Issued By |  |

|---|---|---|---|---|---|

| No results found. | |||||

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

|---|---|---|---|---|---|---|---|

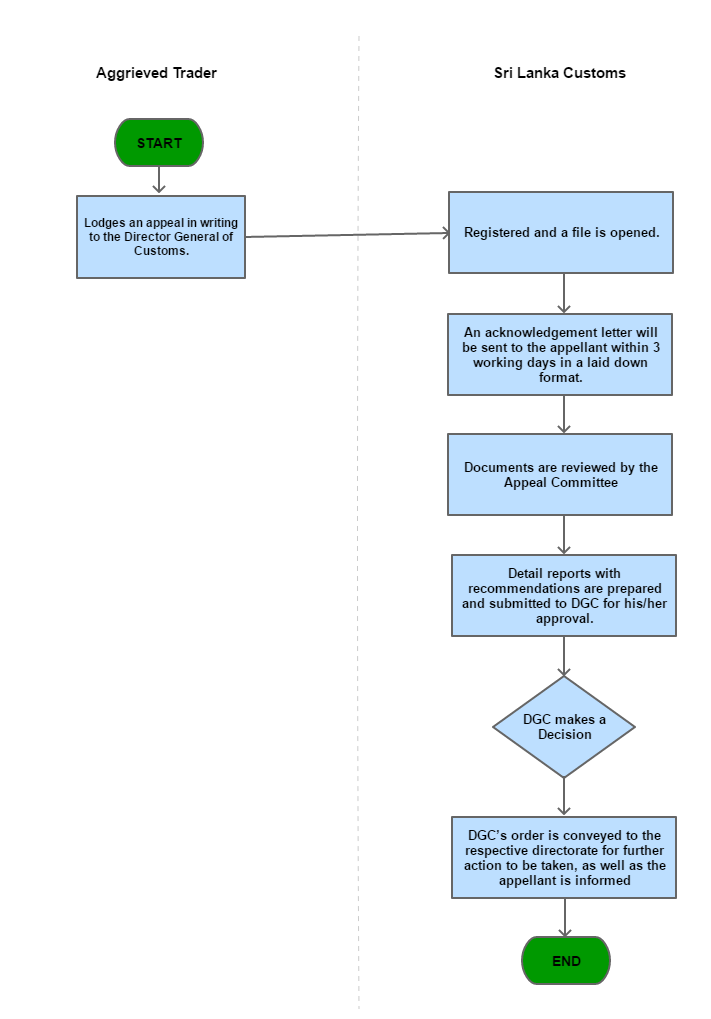

| Requirements for lodge an appeal to custom | Appeal | Appeal is the act by which a person who is directly affected by a decision or omission of the Customs and who considers himself to be aggrieved thereby seeks redress by lodging an appeal in writing to the Director General of Customs. Appeals Directorate was established in year 2014, November, after considering the importance of Appeal Procedure described in Chapter -10 of the Revised Kyoto Convention (RKC) of the World Customs Organization (WCO), and the Article 4 of Trade Facilitation Agreement (TFA) of the World Trade Organization (WTO).This directorate functions directly under the Director General of Customs. Its objective is to facilitate the trade by considering the appeals lodged in writing to the Director General of Customs (DGC). | Appeal is the act by which a person who is directly affected by a decision or omission of the Customs and who considers himself to be aggrieved thereby seeks redress by lodging an appeal in writing to the Director General of Customs. Appeals Directorate was established in year 2014, November, after considering the importance of Appeal Procedure described in Chapter -10 of the Revised Kyoto Convention (RKC) of the World Customs Organization (WCO), and the Article 4 of Trade Facilitation Agreement (TFA) of the World Trade Organization (WTO).This directorate functions directly under the Director General of Customs. Its objective is to facilitate the trade by considering the appeals lodged in writing to the Director General of Customs (DGC). | Customs Ordinance | 31-12-9999 | Good |