| Description |

| Category |

Permit/license |

|

Responsible Agency

|

Department of Import and Export Control

Address: 75 1/3, 1st Floor, Hemas Building, York Street, P.O. Box – 559, Colombo 01

Phone: +94-112-326774

Email: deptimpt@sltnet.lk

|

| Legal base of the Procedure |

Import & Export Control Act No. 1 of 1969 |

| Fee |

Importation of Vehicles under the Foreign Exchange earned

- In the case of 3-5 years old vehicle, 4% CIF Value + Value Added Tax

- In the case of 5-7 years old vehicle, 7% CIF Value + Value Added Tax

Vehicles imported by Foreign Nationals

- 0.3% of CIF + Value Added Tax

Vehicles imported for Disabled Persons

- 10 % of CIF Value + Value Added Tax

Vehicles imported as Donations to the Government and Non-Governmental Organizations

- Government Organizations - Rs. 50, 000 per unit+ Value Added Tax

- Non-Governmental Organizations – Rs. 25, 000 per unit + Value Added Tax

Classic Vehicles

- 10 % of CIF Value + Value Added Tax

Vehicles classified under Machinery but not for agricultural purposes and use on roads

- 7% of CIF Value + Value Added Tax, in the case of a vehicle 7-10 years old

- 9% of CIF Value + Value Added Tax, in the case of a vehicle 10-12 years old

- 11% of CIF Value + Value Added Tax, in the case of a vehicle 12-15 years old

- 13% of CIF Value + Value Added Tax, in the case of a vehicle 15-20 years old

Motor Vehicle Trailers

- Rs. 25,000 per unit + Value Added Tax

Tractors imported for Agricultural Purposes

- Rs. 30,000 per unit + Value Added Tax

Hearses, Vehicles for Welfare Organizations (Ambulances and Garbage Trucks)

- Hearses - Rs. 75,000 per unit + Value Added Tax

- Ambulances and Garbage Trucks – Private Sector – Rs. 50,000 per unit + Value Added Tax

- Ambulances and Garbage Trucks - Government and Semi-government Sector- Rs. 25,000 per unit + Value Added Tax

Other Vehicles (Cars, Vans, Cabs)

- 25% of CIF Value + Value Added Tax : up to 5 years exceeding the period subjected to license control

- 30% of CIF Value + Value Added Tax : over 5 years exceeding the period subjected to license control

Vehicles imported by Resident Foreign Nationals

- 0.3 % of CIF Value + Value Added Tax

Heavy Vehicles

- Rs. 75,000 per unit + Value Added Tax, in the case of a vehicle between 3-5 years old

- Rs. 150,000 per unit + Value Added Tax, in the case of a vehicle between 7-10 years old

- Rs. 200,000 per unit + Value Added Tax, in the case of a vehicle between 10-12 years old

- Rs. 250,000 per unit + Value Added Tax, in the case of a vehicle between 12-15 years old

- Rs. 300,000 per unit + Value Added Tax, in the case of a vehicle between 15-20 years old

Vehicles imported for Re-export after Repairs

- Rs. 10,000 per Car unit + Value Added Tax

- Rs. 5,000 per Motorcycle unit + Value Added Tax

|

Required Documentations for Importation of Vehicles

| No. |

Type |

Notes |

| 1 |

Letter of Request for Import License

|

|

| 2. |

Application Form |

Application IECD- 02 issued by the Department of Import and Export Control - Duly completed and signed by the Importer with seal affixed.

|

| 3. |

Copies of the Photograph and personnel details and the Validity period pages of the Applicant Passport |

|

| 4. |

Where the importer is an organization - Original and a photocopy of the Business Registration Certificate

|

|

| 5. |

Proforma Invoice issued by the Exporter or Supplier

|

|

| 6. |

A valuation report of the vehicle |

from a recognized body of the relevant country |

| 7. |

Two photographs showing front and back side of the vehicle. |

|

| 8. |

Cancellation of Registration (De-Registration) Certificate of the vehicle. |

|

| 9. |

Pre-shipment inspection certificate |

issued by the authorized agency should be submitted at the clearance

Vehicles met with any type of accidents or damage are not permitted to import

|

| 10. |

Other documents |

When required by the Controller General for further clarifications |

Other Required Documentations for Importation of Vehicles under the Foreign Exchange earned

| No. |

Type |

Notes |

| 1. |

Copies of the Photograph and personnel details and the Validity period pages of the Applicant Passport |

Visa should be Dual citizenship Visa, Residence Visa or Work Visa |

| 2. |

Photocopy of valid visa |

To prove that he/she has gone abroad for employment and completed one year in that country. |

| 3. |

A copy of work permit or letter of appointment including the date of appointment with the post held. |

Fax number and E-mail address of the employer should be indicated in the employer's letter

If self-employed relevant documents should be submitted to prove the foreign earnings.

|

| 4 |

Certified Bank statements or letter from the Bank |

to prove the sufficient foreign exchange remittances to Sri Lanka. Minimum foreign exchange remittances should be USD 50,000 during the period of employment abroad.

(Remittances made in the latest six months before the date of application will not be considered in this regard.)

|

| 5. |

Declaration from the applicant |

Stating that applicant will reside in Sri Lanka and the vehicle is for his / her personal use. |

- In the case of 3-5 years' old vehicle, it should have been registered under applicant’s name for over 01 year

- In the case of 5-7 years' old vehicle, it should have been registered under applicant's name for over 03 years

Other Required Documentations for Vehicles imported by Foreign Nationals

| No. |

Type |

Notes |

| 1. |

Copies of the Photograph and personnel details and the Validity period pages of the Applicant Passport |

- The applicant should have a valid residential visa in Sri Lanka for a period exceeding 06 months.

|

*Motor vehicle should not be older than 03 years.

Other Required Documentations for Vehicles imported for Disabled Persons

| No. |

Type |

Notes |

| 1. |

Affidavit confirming disability

|

|

| 2. |

Letter given by the Divisional Secretariat confirming the disability

|

|

| 3. |

Letter issued by the National Secretariat for Persons with Disabilities of the Ministry of Social Empowerment and Welfare confirming the disability

|

|

Other Required Documentations for importation of Classic Vehicles

| No. |

Type |

Notes |

| 1. |

Applicant should have the membership of the Classic Car Club for no less than a year

|

|

| 2. |

Bank Accounts Statements

|

|

Other Required Documentations for for Vehicles imported as Donations to the Government and Non-Governmental Organizations

| No. |

Type |

Notes |

| 1. |

Letter from the Donor Agency

|

|

| 2. |

Recommendation of the Line Ministry under which the recipient organization comes

|

|

Other Required Documentations for imported Vehicles classified under Machinery but not for agricultural purposes and use on roads

| No. |

Type |

Notes |

| 1. |

Bank Accounts Statements

|

|

| 2. |

Recommendation of the Line Ministry to confirm the requirement

|

|

Other Required Documentations for Hearses, Vehicles for Welfare Organizations (Ambulances and Garbage Trucks)

| No. |

Type |

Notes |

| 1. |

Bank Accounts Statements

|

|

| 2. |

Recommendation of the Divisional Secretary obtained through the Grama Niladhari to confirm running of the business

|

|

Other Required Documentations for Other Vehicles (Cars, Vans, Cabs)

| No. |

Type |

Notes |

| 1. |

Bank Accounts Statements (Bank Accounts Statements in respect of last 3 months preceding to the month of the application submitted)

|

|

Other Required Documentations for Vehicles imported by Resident Foreign Nationals

| No. |

Type |

Notes |

| 1. |

Copies of the Photograph and personnel details and the Validity period pages of the Applicant Passport |

Visa should be Dual citizenship Visa, Residence Visa or Work Visa |

| 2 |

Certified Bank statements or letter from the Bank |

to prove the sufficient foreign exchange remittances to Sri Lanka. Minimum foreign exchange remittances should be USD 50,000 during the period of employment abroad.

(Remittances made in the latest six months before the date of application will not be considered in this regard.)

|

| 3. |

Certificates to confirm the relationship between the donor and the recipient

|

|

Other Required Documentations for Heavy Vehicles

| No. |

Type |

Notes |

| 1. |

Bank Accounts Statements

|

|

Other Required Documentations for Vehicles imported for Re-export after Repairs

| No. |

Type |

Notes |

| 1. |

Certificate of Registration of Business

|

|

| 2 |

Letter to confirm registration under the scheme of Temporary Import for Export Processing (TEIP)

|

|

| 3. |

Bank Accounts Statements

|

|

Other Required Documentations for Cut portions of Motor Vehicles

| No. |

Type |

Notes |

| 1. |

Letter issued by the Customs, if purchased from the Customs Auction

|

|

| 2. |

Bank Accounts Statements

|

|

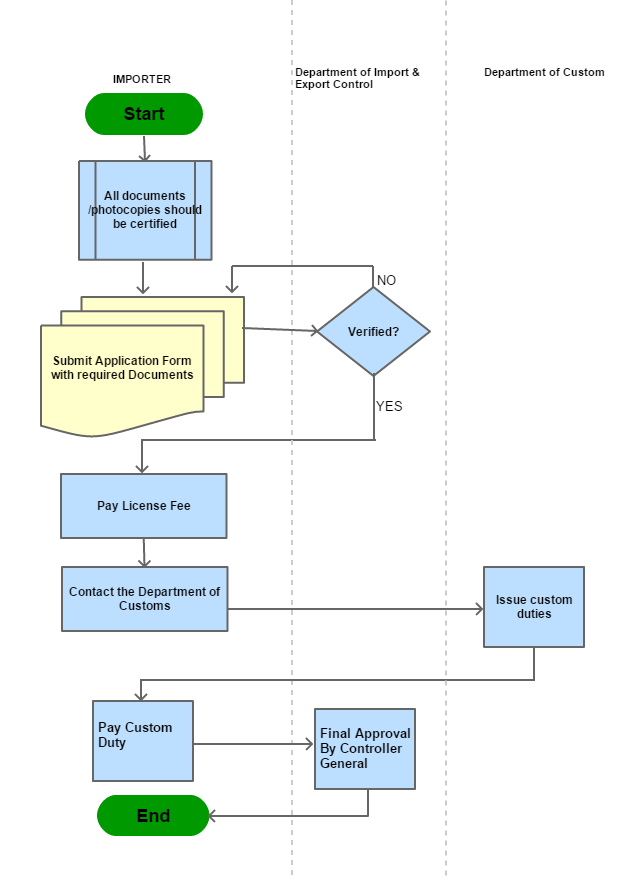

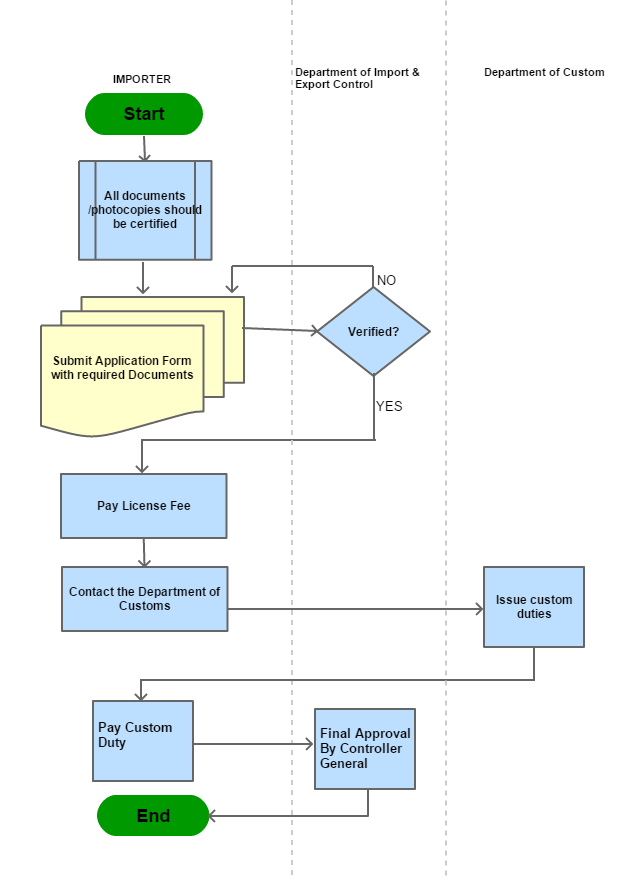

Process Steps

| Step 1 |

All documents /photocopies should be certified as the true copies by the Applicant |

| Step 2 |

Applicant may send his/her application directly to Import Export Control Department by registered post or through a duly authorized person |

| Step 3 |

Applicant required paying a license fee against CIF value of the vehicle. This is payable to the department by a bank draft. |

| Step 4 |

Contact Department of Customs for other relevant duties applicable. |

| Step 5 |

Department of Import – Export Control shall verify the Documents submmitted with relevant agencies. |

| Step 6 |

Final decision will be taken by the Controller General of Import and Export considering the documents submitted by the applicant |

|

|---|